June 4 Trade Recap and Learnings

Today I followed the move down and decided to play with risk management.

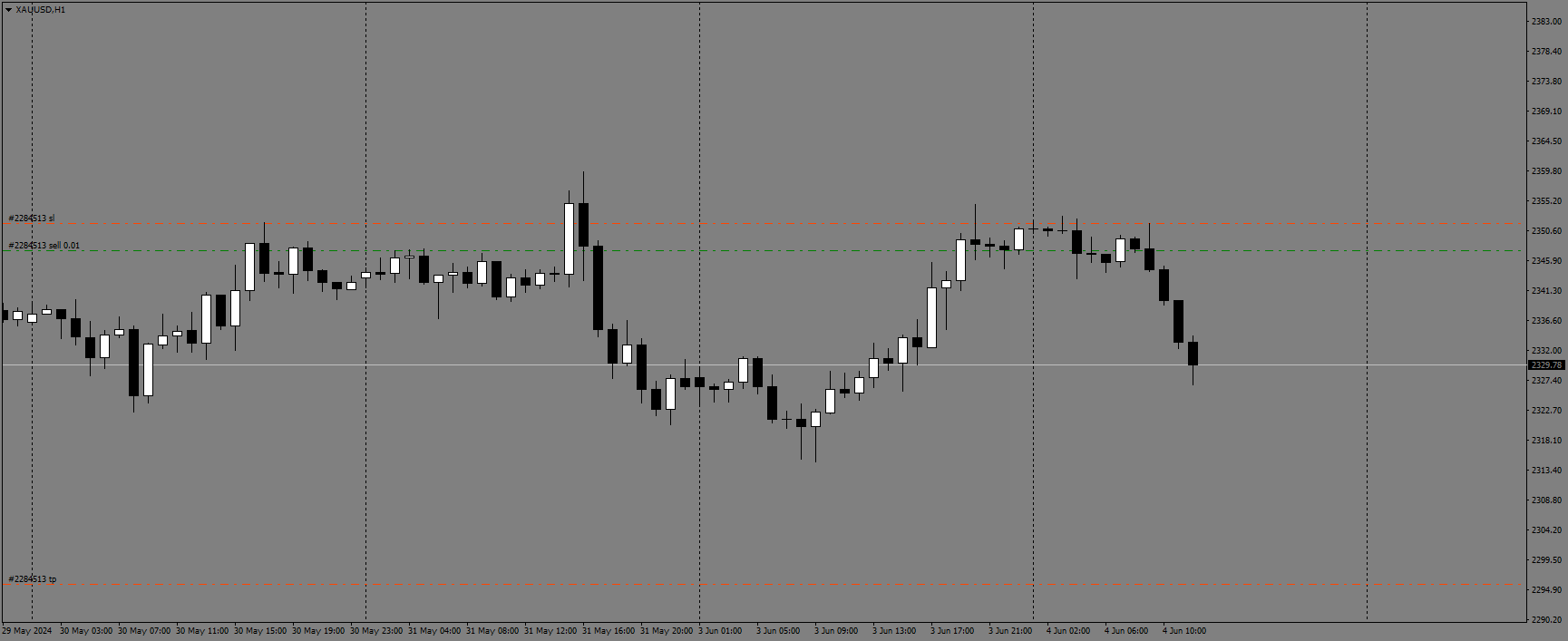

I entered a sell trade around 5:00 candle 10 AM SGD continued after setting a small stop loss as seen in this photo below:

It’s always good to start with demo account so you can learn and practice the move with 0 risk of losing any actual money.

I set a bigger target for the sell in case price continues further down and will follow the move safely with a manually set stop profit as the price moves down in case of reversal. My initial target was the red line all the way below as seen in the photo above.

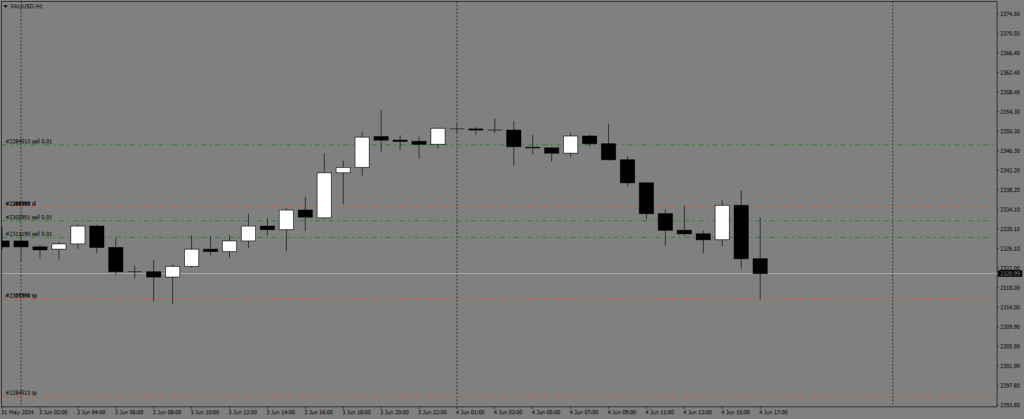

Since my first trade is secure, I can actually win no matter what so I decided to risk a new trade with a small stop loss again.

As you can see in the first trade, there is red line stop profit which is lower than the green entry line.

I set smaller targets initially but was watching the trade and decided to let it ride and will manual exit in case price starts to reverse.

The take profit point I set was touched many times but it did not hit.

This is probably the spread for sell trades is in play.

Learning adjustment: For next time, I will adjust my take profit smaller so the trade would exit faster.

I will add 150 pips higher allowance than my target to account for the spread like today.

When price began to reverse, I manually exited all trades.

I wasn’t able to exit at the lowest point but at least was able to secure and learn for today.

Learning Recap:

- There are certain days where you can win a trade with limited risk provided you entered at the right opportunity and market goes your way.

- There are many ways to limit risk while maximizing harvest when you’ve gotten the direction right like using a very tight 150-200pip stop loss or setting a stop profit when the trade turns a profit.